Paychecks

The images and detail below explain earnings and deductions found on your biweekly paystub.

Top Portion

![]()

This section contains identification and payment information for the employee

Employee Name : First, Middle , Last. Employee Subtitle which is an internal classification.

Social Security Number : Displayed as XXX-XX-last 4 digits for employee security.

Pay Period Ending : The last day of the 14 day period included in this paycheck.

Check Date : Date printed on check indicating when funds are available.

Biweekly : What your position and pay progression is paid for a full pay period. For the 2019-2020 year; annual salary divided by 21.7 for 10 month employees, annual salary divided by 26.1 for 12 month employees.

H.I. Plan : The wage continuation plan that you are enrolled in. Wage continuation is a voluntary insurance. If this block is blank, you are not enrolled in a wage continuation plan, or not yet eligible.

Agency : The funding source for your position.

Org : Location where direct deposit advice will be sent. A live check will be mailed to your home address.

YTD Federal Tax Earnings : Year-to-date earnings that have been subject to federal tax withholding.

YTD FICA Earnings : Year-to-date earnings that have been subject to FICA withholding.

YTD FICA Med Earnings : Year-to-date earnings that have been subject to FICA Medicare withholding.

YTD Gross Wages : Year-to-date gross wages.

Check Number : Identifier for check.

Federal Tax Earnings : Amount of this paycheck’s earnings that are subject to federal tax withholding.

FICA Tax Earnings : Amount of this paycheck’s earnings that are subject to FICA withholding.

FICA Med Earnings : Amount of this paycheck’s earnings that are subject to FICA Medicare withholding.

Retirement Earnings : Amount of this paycheck’s earnings that are subject to Retirement deduction.

Gross Wages : Total wages paid in this paycheck.

Net Pay : Wages minus deductions paid in this paycheck. This field is blank if you have direct deposit.

Direct Deposit : Wages minus deductions paid in this paycheck. Amount that will be deposited in your account.

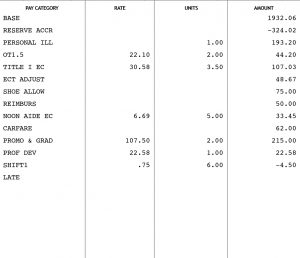

Pay Portion-Middle Left Section

All pay events are listed in this section of the check. Each type of pay is listed separately. Base pay for your regular position will be listed first, then reserve, if appropriate. This is followed by leave pay, extra curricular pay, overtime and other pay events.

- Pay Category– Type of Pay.

- Rate – Pay rate for this category. This is only used for pay types with an attached rate, i.e. EC, Overtime, Per Diem pay.

- Units – For absence, units indicate number of days. A minus associated with a leave indicates a coding reversal. For hourly pay, units indicate number of hours. For daily pay, units indicate number of days.

- Amount – Total paid or subtracted (indicated by a minus sign) for this pay type.

The most common pay categories are:

- Base Pay – Salary earned from your base position. Absences are subtracted from this figure.

- Reserve Accr – Portion of earnings placed into your reserve account.

- Reserve P/O – Amount paid from your reserve account.

- Personal Ill – Payfor personal illness day(s). Also indicates the number of personal illness days used in the pay period.

- Personal Lv – Pay for personal leave day(s). Also indicates the number of personal leave days used in the pay period.

- Vacation – Pay for vacation day(s). Also indicates the number of vacation days used in the pay period.

- Invalid Lv – Absence day for a probationary employee; therefore, you received an unpaid leave day.

- No Avail Lv – There was no available leave day(s) of the type coded; therefore, you received an unpaid leave day(s).

- Lv W/O pay – Approved leave without pay.

- Unauthorized – Unauthorized leave without pay.

- Other Comp – Days paid from workers’ compensation.

- Other Supp – Supplement to your workers’ compensation payment.

- B/A**** Balance account reclaiming overpayment made to the employee. This is subtracted from gross.

- Opt Out Payment to eligible employees that waive enrollment in the School Districts medical, dental and prescription plans. The payment is taxable for Federal, State and local income tax withholding.

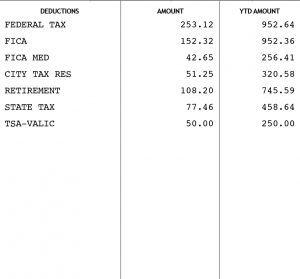

Deduction Portion – Middle Right Section

Deductions can be separated into three categories. Mandatory deductions, which include taxes and retirement, must be withheld. The percentages are set by the governing agency. Voluntary deductions, which include insurance and charities, are withheld at the employee’s direction. Ordered deductions are the result of a court or garnishment order. These are withheld and terminated only at the direction of the administering agency. If you have questions about a deduction on your check, contact the administering office. Deductions below followed with an (*) are administered by Payroll. Deductions with an (#) are administered by Benefits Management.

Deductions – Type of deduction.

Amount – Total withheld for this paycheck. A minus indicates a refund of money previously withheld.

YTD Amount – Total withheld for the calendar year.

The most common deductions are:

- Addl Fed Tx* – Voluntary Additional federal tax you have requested be withheld above the calculated federal tax withholding. This can be changed by filing a new W4 form with the new figure or a $0 in the additional federal tax block.

- Federal Tax* – Mandatory You may change your withholding by filing a new W4 form.

- FICA* – Mandatory Also known as the Social Security deduction. Maximum earnings subject to FICA for 2020 is $137,700.

- FICA Med* – Mandatory Deduction for the Medicare portion of FICA.

- State Tax* – Mandatory For Pennsylvania Residents only.

- State Unemployment Tax* – Mandatory Employment tax.

- City Tax Res* – Mandatory For Philadelphia residents.

- City Tax Nres* – Mandatory For non Philadelphia residents.

- Retirement Deduction# – Mandatory Percentage of earnings contributed to your PSERS account.

- Dues* (PFT, CASA, SPAP, 1201, 634) – Mandatory Full membership dues in the union that represents your position.

- Fair* (PFT, CASA, SPAP, 1201, 634) – Mandatory Fair share union dues for anyone who holds a position represented by a union but is not a member. All non-probationary employees in positions represented by a union are assessed dues.

- Wage Con# – Voluntary Wage continuation insurance payment.

- Life ins# – Voluntary School district sponsored life insurance policy payment.

- Univ Life# – Voluntary Universal Life insurance policy payment.

- Family Court* – Ordered Child Support deduction is forwarded to state or county ordering payment.

- PHEAA* – Ordered Pennsylvania Higher Education Assistance Authority.

- Garn Fee* – Administrative fee charged for processing a garnishment (2% of the biweekly deduction).

- Charity* – Voluntary Contribution to United Way combined campaign.

- TSA* – Voluntary The type of account, either 403b or 457b, is indicated.

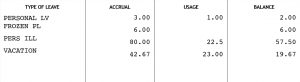

Leave Banks – Lower Left Section

Only accrued leave is listed in this section. Certain types of leave of which a certain amount is automatically available to all employees, including Illness in the family, and jury duty, are not listed.

Type of Leave – Leave that is accrued. Annual accrual is granted in September.

Accrual – Amount that you have accrued since January 1999 *Personal leave will display only the current year because the prior year balance is moved to the frozen bank.

Usage – Amount that you have used since January 1999. Usage for the pay period is indicated in the units field of the pay portion.

Current plans call for a change in the way accrual and usage is displayed.

Balance – Total days currently available for each type.

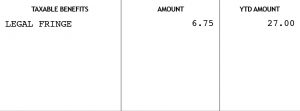

Taxable Fringe Section- Lower right portion

Taxable fringes are benefits paid for by the employer, but taxable to the employee. The listed figure is not paid to you, only added to your taxable earnings.

Taxable Benefits– Type of benefit; there are two:

- Legal Fringe – Contributions to your legal services fund.

- Car Allowance – Taxable value of school district vehicle under the employee’s control.

ACCESSING PAY STATEMENTS ON THE SCHOOL DISTRICT WEBSITE

Your School District of Philadelphia email name and password are used for access. If you do not know the name and password, call the IT help desk at 215 400-5555.

From the School District of Philadelphia main website (http://www.philasd.org) go to the Master Login. In the Employee section, enter your email name and password. Launch the “Payroll Information” application. Enter the last four digits of your social security number when prompted. Select Pay Statements. At this point you may choose to access your most recent statement, statements in a particular date range, or all of the statements for the current year and the two proceeding years.

You must have a current version of Adobe Acrobat to view the direct deposit pdf format.