**IMPORTANT UPDATE ABOUT YOUR PENSION**

Public School Employee Retirement System (PSERS) pension contribution rates for School District of Philadelphia (SDP) employees in PSERS pension classes T-E, T-F, T-G and T-H will decrease effective 7/1/2024 for any salary earned on or after 7/1/24. However, you will not see the changes reflected in your pay until the August 30, 2024 pay. Please see below for the prior and current rates for the respective classes:

For more information about your pension class, your pension balance, or questions about the change in rate, please contact PSERS directly at 1-888-773-7748. You may also register for their member self-service portal at https://rb.gy/876g4w. Only classes T-G and T-H will have a Voya plan. You can see more information about your Voya plan on their self-service portal at psersdc.voya.com or by contacting them directly 1-833-432-6627.

Welcome to the School District of Philadelphia!

The School District of Philadelphia (SDP) is a participant of the Public School Employees’ Retirement System (PSERS). PSERS is an agency of the Commonwealth of Pennsylvania who administers the pension plan for Pennsylvania’s public school employees.

As a PSERS member, you will join over a half million fellow public school employees who are referred to as members to PSERS. You will contribute to your own personal PSERS pension account and profit from having a safe, secure, and guaranteed benefit payment(s) from one of the largest public pension plans in the nation.

The pension is mandatory for all employees scheduled to work 25 hours or more a week. There are many benefits to being enrolled:

- Saving for your future through automatic contributions from your pay

- Money you can access upon separation including interest gained

- Eligibility to collect a monthly pension check depending on length of employment

- Supplemental income to social security benefits

- Savings for beneficiaries in the event of your death

Depending on your membership class, you may have a stand-alone Defined Benefit (DB) Plan, a stand-alone Defined Contribution (DC) Plan, or a hybrid with both DB and DC components. PSERS pension contributions are housed as your DB plan. Hybrid plans require contributions separately to the DC plan with wealth and investment company, Voya Financial Inc. Only members contributing for the first time effective July 1, 2019 to the present would either be in a hybrid plan or a stand-alone DC plan.

Members who contributed prior to July 1, 2019 would remain in the same pension class at the time of hire which are stand-alone DB plans with PSERS only.

Foundations For Your Future (FFYF)

FFYF are PSERS seminars that are designed to give public school employees an overview of their retirement benefits. These seminars provide all active members with general information about PSERS’ benefits and services. Attendance at a FFYF seminar will help you begin to plan for your retirement early in your career. Each seminar lasts approximately 90 minutes. These seminars are provided solely for the education of members of PSERS. Financial planners will not be permitted to solicit business at these seminars. prior to attending the Exit Counseling Session. Emphasis at the Exit Counseling will be on completion of the retirement application and related forms. The Foundations for Your Future programs provide a broader overview of PSERS benefits and retirement and are designed to prepare you to proceed onto the more detailed information and the completion of the paperwork presented during an Exit Counseling session.

PSERS and Voya Member Self Service Portals

To view your personal pension information or to change your pension class enrollment, please register for the PSERS’ Member Self Service portal. You will need your PSERS ID number to do so. This can only be obtained from documents received from PSERS either in the US postal mail or email or by contacting them directly at 1-888-773-7748. The self-service portal also allows members to see other pertinent data included but not limited to their current and past work statuses with PSERS, what salary, service and contributions have been reported per school year, beneficiaries (and the ability to update beneficiaries) and demographic information. If you are enrolled in a Voya plan, all changes with PSERS will be automatically sent to Voya from PSERS.

To register or view general and personal information regarding Voya and your DC plan, please visit here or call 1-833-432-6627.

The pension department has limited accessibility to member data. The pension department can only see and update your demographic information (excluding the ability to update the SSN or date of birth) and work statuses.

Although you are auto-enrolled, we ask that you take 2-3 minutes to complete the pension enrollment form by hovering a smart phone’s camera over the QR code below. You may also click here to access the enrollment form. To view just the presentation, please visit the Pension Information.

Please Note: Pension Counseling Emails

We remind you that neither PSERS nor the School District of Philadelphia will provide your contact information to third parties. If you receive unsolicited calls or emails offering retirement counseling or investment, please use caution and do not provide personal information.

Pension Class Enrollment

The rate associated with each class is the percentage of your pre-tax salary that is deducted each pay.By default, members contributing for the first time, effective 7/1/2019, are enrolled in pension Class TG. New members have 90 calendar days from the first day worked, to enroll in one of two other pension classes: Class TH and Class DC. Switching to a different class is a lifetime enrollment that is irrevocable. If a new member does not switch to a different class, PSERS will assume you want to remain in Class TG which is also a lifetime, irrevocable enrollment.

*Effective July 01, 2024, PSERS defined benefit rates will decrease to a lower rate. This will not affect the defined contribution with Voya. Please see the rates below:

| Class T-G (Default) Hybrid Plan | Class T-H Hybrid Plan | Class DC Standalone Plan (no DB/pension ) |

|

|---|---|---|---|

| Total Member Contribution Rate | 8.25% (DB: 5.50% + DC: 2.75%) | 7.50% (DB: 4.50% + DC: 3.00%) | 7.50% (DC Only) |

| Employer Contribution Rate to Member's DC Account Only | 2.25% | 2.00% | 2.00% |

If you began contributing to PSERS prior to 7/1/2019, you are enrolled in one of the following classes: TC, TD, TE, or TF. To confirm which class you are enrolled, you may contact PSERS directly. For detailed information, please click here.

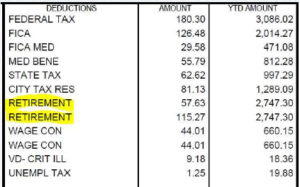

Why are there two Retirement deductions on my paycheck?

Members enrolled in a hybrid plan will see two ‘RETIREMENT’ deductions from their pay. This is because the contributions are going to two different entities (PSERS and Voya) and must be deducted separately.

Annual PSERS and Voya Statement of Accounts

PSERS sends members an annual statement of their account typically around November or December. The statement outlines salary, service and contributions earned from July 1-June 30 of the school year prior. If you are enrolled in the hybrid plan or stand-alone, DC plan with Voya, you will also receive an annual statement from Voya typically in the spring. Click here for more information.

Virtual Office Hours

The Pension Office offers virtual office hours twice a month on Wednesdays from 3:30 pm to 4:00 pm. The Pension Office will be available to answer any general questions concerning the pension. For:

New Hires: Register in advance here

Separating from Service: Register in advance here

For specific information about your pension, please contact PSERS directly. If you are not able to join our office hours, please feel free to register for the next one or contact our office directly.